Quantify

To seed-stage investing, we bring both the art of human judgment and the science of calculated risk. We use the term “calculated risk” literally. We explicitly calculate probability-weighted returns and require a 10x pwMOIC (probability-weighted multiple of invested capital) or a 40% pwIRR to invest.

In the prior Analyze stage, we dig in to learn what is knowable about the opportunity. There will always remain uncertainties around product success, market adoption, and team execution. In this Quantify stage, we confront uncertainty head-on to calculate probability-weighted returns.

Our approach can be broken down into three steps:

Describe the tree of possible outcomes with associated probabilities

For each outcome, calculate investment return or MOIC

Probability-weight the outcomes to calculate pwMOIC

1. Describe the Outcome Tree

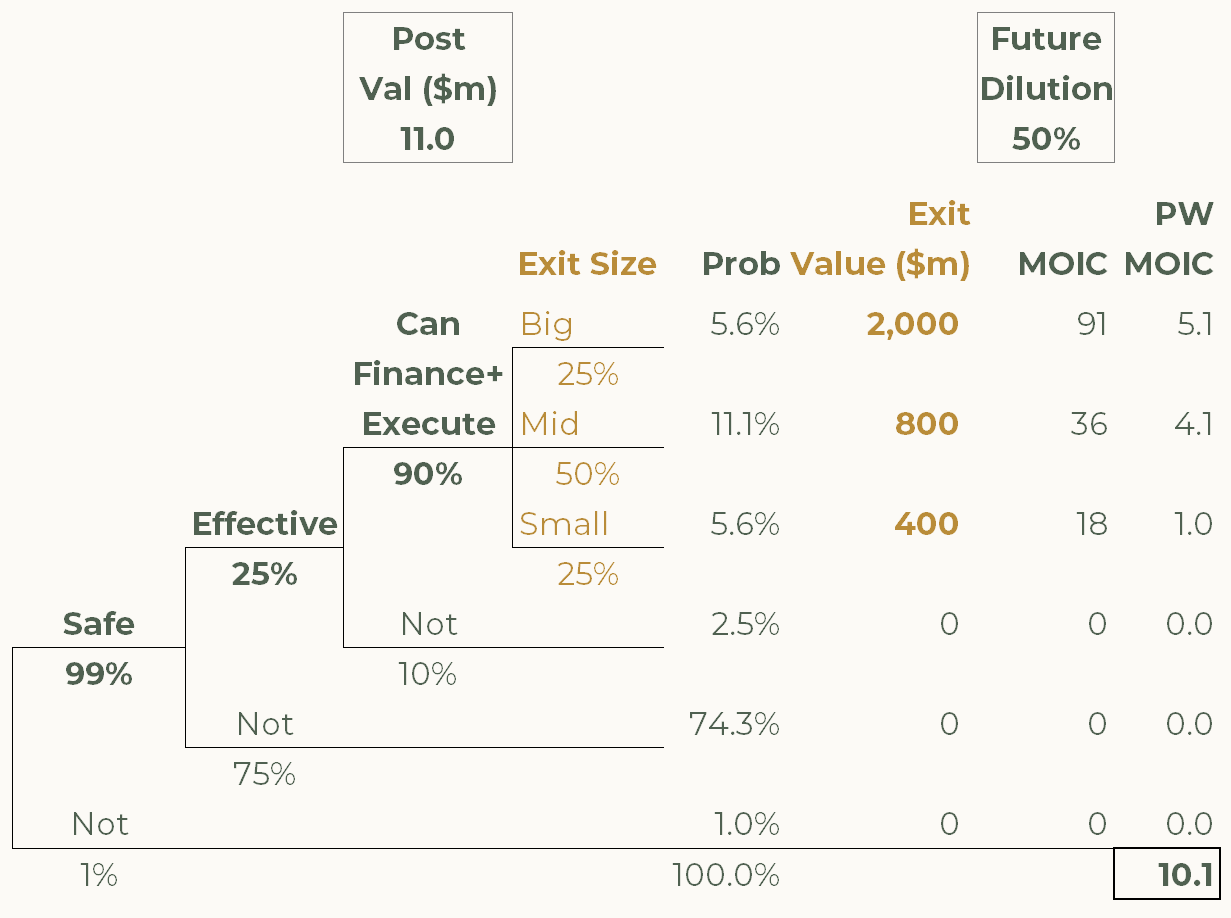

Here is a simplified example for fictional NewDrugCo with a new drug called MM102 (Magic Molecule 102) for Hyper Fictional Liver Disorder (HFLD). HFLD is an orphan disease with horrible morbidity and mortality and a lack of effective treatments.

Probability of “Safe”: Normally, only 50% of drugs in this category are shown to be safe in humans in clinical trials. Here is where NewDrugCo has a leg up. They are repurposing a drug that has been used for a different disease by hundreds of thousands of patients and is quite safe, so we assign a 99% chance that MM102 will be shown safe in clinical trials.

Probability of “Effective”: It turns out that 25% of drugs in this category that begin clinical trials are found to be effective. Each one starts trials with high hopes and with multiple studies in labs and in animals showing effectiveness; yet (of those that don’t fail for safety issues), 75% of them fail for lack of efficacy. NewDrugCo has extensive data supporting its proposed mechanism of action. They have 8 different efficacious animal studies with statistically significant data from 4 different well-respected research institutions. They are ready to file their IND to get approval from the FDA to begin trials. NewDrugCo’s impressive array of pre-clinical data earns them a 25% chance of clinical efficacy success, just like all the other hopefuls in this class of therapies.

Probability of “Can Finance and Execute”: an industry veteran is leading NewDrugCo. After 5 successful exits, she was ready to retire at age 53; however, her nephew is ravaged by HFLD, and fighting the disease has become her passion. About 20% of drug candidates fail clinical trials for reasons other than safety or efficacy (that is, given safety and efficacy, 80% succeed). For example, a company may not have followed FDA protocol, trials were paused, and funding for the project dried up. An inexperienced team has a lower chance of execution success, but, given this CEO’s tremendous track record of raising capital and getting drugs approved, we increase the chance of execution success to 90%.

Exit Size: A safe, effective treatment for HFLD is expected to be worth an estimated $1b per year in peak sales. NewDrugCo aims to sell the company after a successful phase 3 trial, and based on their strong patent portfolio, a successful phase 3 could result in $400m to $2b in exit value. Assuming success on the other factors, we summarize the range of possible exit values as a 25% chance of a $400m exit, a 50% chance of an $800m exit, and a 25% chance of a $2b exit.

Post-Money Valuation ($11m). They are raising $1m in this seed financing (to file their IND) on a $10m pre-money valuation, so an investment now would imply an $11m post-money valuation.

Future Dilution (50%): While future dilution is uncertain and dependent on several factors, we have looked at their clinical development budgets, strategy for future fundraising, availability of supportive grants, and we estimate future dilution at 50%. That is, the company, after this financing but before exit, will have to sell 50% of the company to raise the capital required to run clinical trials.

2. For Each Outcome, Calculate MOIC

Our simplified tree above has 6 possible outcomes. Three of those outcomes would result in a 0.0 MOIC (multiple of invested capital), meaning that an investor would lose their entire investment in NewDrugCo. Those three outcomes correspond to failure of safety, efficacy, or execution.

But what if the Big outcome is achieved? If the company does have a $2b exit, then (given 50% future dilution and given that the post-money valuation of this investment is $11m) that would imply a 91x multiple on investment in this round. Similarly, an $800m exit would yield a 36x, and a $400m exit would yield 18x.

In general, for a given outcome, MOIC = ExitValue*(1-FutureDilution)/PostVal

3. Probability-Weight the Outcomes to Calculate pwMOIC

The probability of achieving the Big outcome is only 5.6%. That is the product of the probabilities of the paths leading to the outcome: 99% (safe) times 25% (effective) times 90% (execute) times 25% (Big exit). Similarly, the chance of achieving the Mid outcome is 11.1%, and the Small is 5.6%. The three paths with zero outcome add up to (2.5% + 74.3% + 1.0%) 77.8%. Note that the sum of probabilities for the 6 outcomes adds to 100%.

Next, we multiply the probabilities times the MOICs and add them up. So (5.6% * 91x) + (11.1% * 36x) + (5.6% * 18x) + (77.8% * 0x) = 10.1x. We require at least a 10x multiple to invest, so this meets our minimum requirement and we decide to invest.

Note on terminology: Mathematically, multiplying outcomes by their respective probabilities, and taking the sum, is called taking the “expected value.” We do not use the term “expected value” since it can be confusing. The mathematically expected value of the roll of one die is 3.5, but of course, no one expects to roll a 3.5. So, we use the term “probability-weighted multiple of invested capital” (pwMOIC) or sometimes “risk-adjusted” MOIC (rMOIC).

For some extra background on Decision Analysis, click here.

Keeping the Bar High

Requiring a 10x probability-weighted MOIC is forcing an investment to jump over a high bar. Often companies present only the Big outcome in their pitch decks and make claims like “we are targeting a 20x return for investors”. You don’t often see a pitch deck where the CEO multiplies the Big outcome times a reasonable probability of total failure. Note that in our NewDrugCo example, the Big outcome would yield a 91x. However, the chance of a big outcome is small. The probability-weighted outcome is 10.1x

The high risk of failure is a reality that plagues not only biotech investments but all early-stage investments. Software companies typically have a higher chance of technical success; however, the market risk of not achieving their wildly optimistic sales projections is high.

Depending on the investment stage, about 50% to 75% of early-stage companies will fail to return investors’ capital. This exercise in calculating pwMOIC is not about second decimal place accuracy. The goal is to confront the risks head-on. We aim to ground the evaluation of any deal in risks of similar endeavors and to adjust the probabilities of the deal in question only with compelling evidence. We approximately answer how big the risk is (how big is the chance of failure) and how big the upside is if it succeeds.

pwIRR

On rare occasions, we see a company with a well-defined path to a near-term (2 to 5 year) exit. For those companies, in addition to pwMOIC, we will also calculate pwIRR and will invest if the pwIRR exceeds 40%. Our pwMOIC analysis doesn’t take into account time. Implicitly embedded in our 10x pwMOIC hurdle is an expectation that the payout will occur in about 10 years (typically 7 to 12 years). A 10x return in 10 years would equate to an IRR of 26%. Why don’t we use 26% pwIRR as our hurdle? Unlike MOIC, IRR requires us to estimate the timing of an exit. And this introduces another opportunity for asymmetric error. All projects are likely to take more time than expected, so our estimate of time until exit is likely to be too low. We counteract this in two ways. First, we separately consider the risks that could lead to timing delays and tend to use the long end of the distribution. If, after considering timeline risks, we arrive at a range of possible exit dates from 2 years (if everything goes to plan) to 5 years (if material delays are incurred), we will use a number closer to 5 years to estimate exit timing. Further, we set the bar higher and require the deal to achieve a pwIRR of at least 40%. (40% IRR corresponds to about a 3x at year 3, a 5x at year 5, or a 10x at year 7).

In summary, we typically require 10x pwMOIC to invest. For deals where there is a strong reason to believe in an early exit, we will risk adjust the timeline and invest where the pwIRR is at least 40%.

Can’t I Just Look at X for a Shortcut?

No. All the factors discussed here directly and significantly matter: the probability of success, size of the outcome given success, post-money valuation, and future dilution. Mistakes are made when any of these factors are ignored.

Value of Large Portfolio

“Wait a minute, did you just say that you ARE going to invest in NewDrugCo even though it has a 78% chance of failure?” Yes.

We would not advise anyone to invest in NewDrugCo if it were the only investment they make in a year. But making 50 investments into companies with this risk profile would lead to 10x average return from a portfolio perspective. Hence “SeedFolio,” a large portfolio of seed-stage investments.

Does that mean you are promising investors in SeedFolio a 10x return on their investment? No. We are targeting 5x gross return on capital invested by SeedFolio. We realize that any attempt to quantify probability-weighted returns will be subject to error. Not just random error, but negatively skewed error. We realize that we are more likely to miss a downside failure mode than an upside success mode. By keeping the bar at 10x pwMOIC, it is equivalent to having the bar for each deal at the real target 5x while adding a risk factor for every deal of a 50% chance of failure due to some other unknown unknown.

(To learn about the next stage in our process, click “Verify” at the bottom right of this page.)