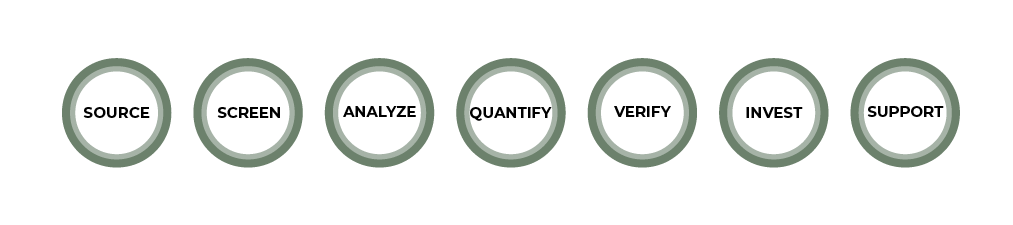

seedfolio’s process

Click an image below for more detail on that process step.

We have developed a river of deal flow. This week the river was a bit higher than usual. Here is what it looked like…

Since we enjoy a river of deal flow, we get to be choosy. Focus is the art of saying “no”. We can quickly say “no” to the vast majority of companies we see based on their pitch deck or a 5-minute presentation. What we look for in our initial screening is…

When a company passes our initial screen, we begin to analyze it. We have a multi-hour kickoff meeting with the CEO and other founders to dig in and understand in detail the drivers of risk and value for the company…

To seed stage investing, we bring both the art of human judgement and the science of calculated risk. We use the term “calculated risk” literally. We explicitly calculate probability-weighted returns and require a 10x pwMOIC…

After we Quantify a company and it clears our high bar, we invest time verifying the story. Up until now we have trusted data from the company and from quick web searches. Now is the time to Verify our information bases. Here are some ways we do that…

After we Verify that this deal is the one in one hundred that is worthy of investment, we have a few structural details we prefer to see…